Trust Foundations: Trusted Solutions for Your Building and construction

Trust Foundations: Trusted Solutions for Your Building and construction

Blog Article

Protecting Your Possessions: Trust Structure Expertise within your reaches

In today's complex economic landscape, ensuring the protection and development of your properties is critical. Depend on structures act as a keystone for securing your riches and heritage, supplying an organized technique to property defense. Proficiency in this realm can offer important guidance on navigating legal complexities, maximizing tax effectiveness, and developing a durable financial strategy tailored to your distinct requirements. By using this specialized expertise, people can not just protect their properties successfully however also lay a strong foundation for long-term riches conservation. As we check out the ins and outs of count on foundation know-how, a globe of opportunities unravels for fortifying your financial future.

Value of Depend On Foundations

Trust structures play a vital role in developing credibility and cultivating strong connections in numerous professional setups. Building depend on is important for organizations to thrive, as it develops the basis of effective partnerships and collaborations. When trust is existing, people feel more confident in their interactions, resulting in increased productivity and performance. Depend on structures act as the foundation for ethical decision-making and clear communication within organizations. By focusing on depend on, companies can produce a favorable job society where workers really feel valued and valued.

Advantages of Specialist Assistance

Structure on the foundation of rely on professional partnerships, looking for specialist advice offers vital advantages for people and companies alike. Professional advice supplies a riches of knowledge and experience that can aid navigate complex economic, lawful, or calculated difficulties easily. By leveraging the expertise of professionals in different fields, individuals and companies can make informed decisions that straighten with their goals and goals.

One considerable benefit of professional guidance is the ability to access specialized expertise that might not be easily offered otherwise. Experts can offer insights and viewpoints that can result in cutting-edge options and opportunities for growth. Furthermore, dealing with specialists can help reduce threats and unpredictabilities by providing a clear roadmap for success.

Furthermore, specialist advice can save time and resources by enhancing processes and preventing expensive mistakes. trust foundations. Experts can use personalized suggestions customized to specific requirements, making certain that every decision is knowledgeable and critical. Overall, the benefits of expert advice are complex, making it a beneficial possession in securing and optimizing properties for the long-term

Ensuring Financial Security

Making certain monetary safety includes a complex method that incorporates various aspects of wide range administration. By spreading out financial investments across different possession courses, such as stocks, bonds, actual estate, and products, the threat of substantial monetary loss can be minimized.

In addition, keeping an emergency fund is vital to protect versus unforeseen expenditures or earnings disruptions. Specialists advise alloting three to 6 months' well worth of living costs in a fluid, easily obtainable account. This fund works as an economic safeguard, supplying peace of mind during her response rough times.

Regularly evaluating and readjusting financial plans in response to altering conditions is likewise vital. Life events, market fluctuations, and legal changes can influence financial security, highlighting the importance of continuous examination and adaptation in the search of long-term monetary protection - trust foundations. By implementing these techniques thoughtfully and continually, individuals can fortify their economic footing and work towards a much more secure future

Safeguarding Your Possessions Efficiently

With a solid structure in place for economic protection through diversity and emergency fund maintenance, the following important action is protecting your possessions successfully. Safeguarding assets includes safeguarding your wide range from possible threats such as market volatility, economic slumps, claims, and unpredicted expenses. One effective technique is property allotment, which entails spreading your financial investments across numerous asset classes to minimize threat. Expanding your profile can aid minimize losses in one area by stabilizing it with gains in one more.

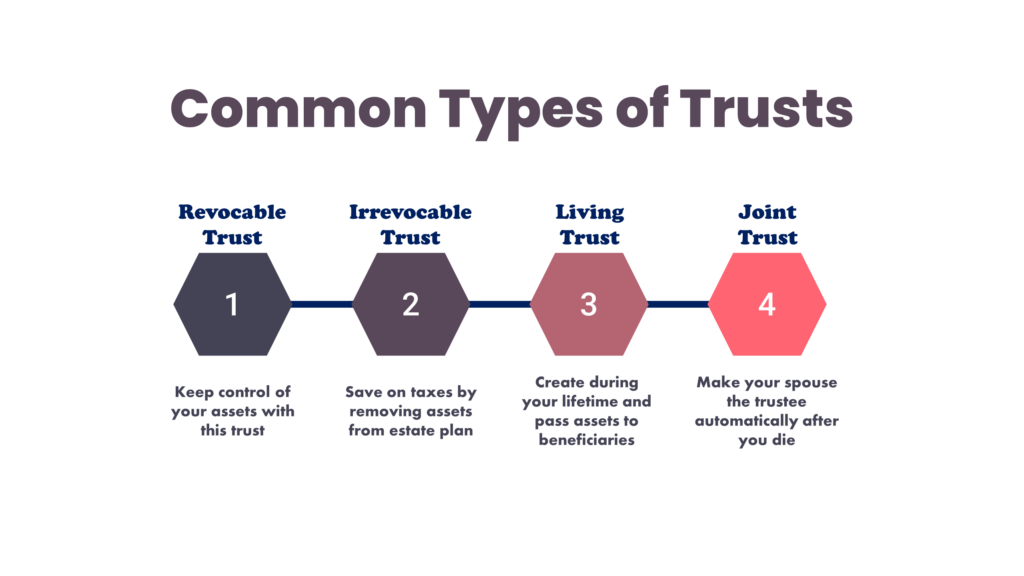

In addition, establishing a trust can supply a secure way to shield your properties for future generations. Depends on can help you regulate exactly how your assets are dispersed, minimize estate tax obligations, and secure your wide range from lenders. By implementing these methods and looking for professional recommendations, you can protect your properties properly and secure your economic future.

Long-Term Property Defense

To ensure the enduring security of your wealth versus potential threats and uncertainties with time, tactical preparation for lasting possession security is important. Long-term asset defense involves implementing steps to secure your assets from numerous dangers such as economic declines, legal actions, or unanticipated life events. One important aspect of lasting possession defense is developing a count on, which can supply substantial benefits in shielding your properties from creditors and legal disputes. By transferring possession of properties to a trust fund, you can shield them from prospective risks while still maintaining some degree of control over their management and circulation.

Additionally, expanding your financial investment portfolio is an additional key strategy for lasting asset security. By spreading your try these out investments across various possession courses, industries, and geographical regions, you can decrease the effect of market changes on your general riches. Additionally, on a regular basis evaluating and upgrading your estate strategy is important to ensure that your possessions are safeguarded according to your dreams over time. By taking an aggressive method to long-term possession defense, you can guard your wealth and offer economic safety and security on your own and future generations.

Final Thought

To conclude, trust fund structures play an essential function in securing properties and ensuring economic safety and security. Specialist assistance in developing and taking care of count on structures is essential for lasting asset security. By utilizing the knowledge of experts in this area, individuals can successfully protect their properties and prepare for the future with confidence. Trust fund structures offer a strong structure for safeguarding wide range and passing it on future generations.

Report this page